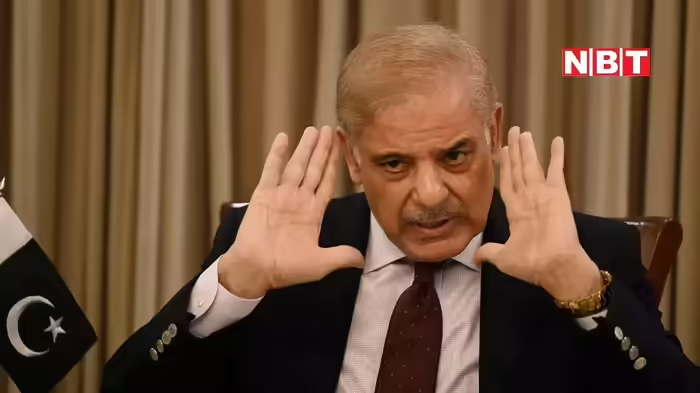

Pakistan’s Prime Minister Shehbaz Sharif has opened up about the challenges and personal compromises involved in securing international loans for the country. In a video that is currently circulating on social media—though the exact date and venue are unclear—Sharif candidly described how seeking foreign aid often comes at the cost of national dignity.

Shehbaz Sharif Speaks

Sharif recounted that he, along with Field Marshal Asim Munir, visited multiple countries to request financial assistance in support of Pakistan’s IMF programme and to bridge the nation’s external funding gap. “The friendly countries we approached did not disappoint us,” he said. “But anyone who asks for money must bow their head. There is always a price to pay, and compromises are inevitable.”

He explained that while foreign lenders were cooperative, there were occasions when Pakistan had to accommodate demands it would not have otherwise accepted. “I want to be clear—whether you like it or not, sometimes you must implement the wishes of the lender,” he said. “This is the burden that comes with borrowing.”

Compromises Acknowledged

Sharif expressed gratitude to the countries that supported Pakistan but did not shy away from acknowledging the difficult choices involved. “Whenever you ask for help, you pay a price in terms of your dignity. Compromises are unavoidable,” he admitted, highlighting the delicate balance Pakistan must maintain in international financial negotiations.

Pakistan’s Growing Debt Burden

The Prime Minister’s remarks come against the backdrop of Pakistan’s deepening debt crisis. As of December 2025, Pakistan’s total external debt stood at $52.366 billion, up from $47.071 billion in November 2025. According to the fiscal policy presented in Parliament, the debt burden per Pakistani increased by 13% over the previous year, rising to PKR 333,000 per person from PKR 294,098 in FY 2023–24.

The statements underline the pressure on Pakistan’s leadership as the country struggles to manage its finances and meet obligations to international creditors while grappling with internal economic challenges.

Discover more from SD NEWS agency

Subscribe to get the latest posts sent to your email.