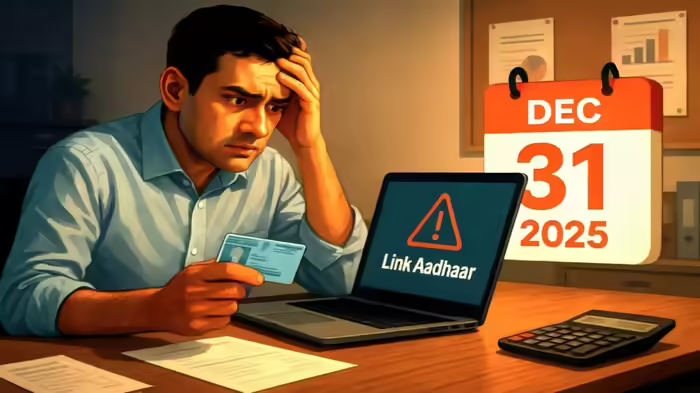

Last Chance Before New Year: Link Your PAN with Aadhaar or Face Serious Consequences

The deadline to link your PAN (Permanent Account Number) with Aadhaar is fast approaching. According to the Income Tax Department, all PAN cards must be linked with Aadhaar by 31st December 2025. Missing this deadline will render your PAN inoperative from 1st January 2026, causing severe disruptions in banking, investments, and income tax filing. A late fee of ₹1,000 is applicable for completing the process now.

Time is Running Out

If you haven’t linked your PAN with Aadhaar yet, this is your last chance. The Income Tax Department has emphasized that those who were allotted PAN cards based on Aadhaar before 1st October 2024 must complete the linking process by the end of this year. Failing to do so will make your PAN inactive starting 1st January 2026. Since the initial deadline has ...