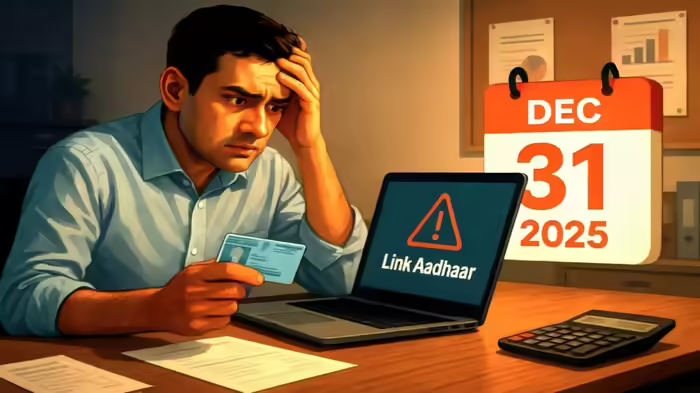

The deadline to link your PAN (Permanent Account Number) with Aadhaar is fast approaching. According to the Income Tax Department, all PAN cards must be linked with Aadhaar by 31st December 2025. Missing this deadline will render your PAN inoperative from 1st January 2026, causing severe disruptions in banking, investments, and income tax filing. A late fee of ₹1,000 is applicable for completing the process now.

Time is Running Out

If you haven’t linked your PAN with Aadhaar yet, this is your last chance. The Income Tax Department has emphasized that those who were allotted PAN cards based on Aadhaar before 1st October 2024 must complete the linking process by the end of this year. Failing to do so will make your PAN inactive starting 1st January 2026. Since the initial deadline has already passed, a penalty of ₹1,000 is now applicable.

How It Will Affect Your Transactions

Once your PAN becomes inactive, you will face significant difficulties:

- Opening new bank accounts will not be possible.

- Issuance of credit or debit cards will be blocked.

- Deposits exceeding ₹50,000 and banking transactions above ₹10,000 may be severely restricted.

- Investments through mutual funds or stock brokers could be suspended.

Additionally, filing your Income Tax Return (ITR) will become impossible. If attempted, the return may be rejected. High TDS/TCS rates may apply, and tax credits will not reflect in Form 26AS, making refunds and tax benefits inaccessible.

How to Link PAN with Aadhaar

The linking process is simple:

- Visit the Income Tax e-Filing portal.

- Go to Quick Links and select Link Aadhaar.

- Pay the ₹1,000 late fee.

- After verification, re-enter your PAN and Aadhaar details on the portal.

- Complete OTP verification to submit the request.

Note: Ensure that the name and date of birth on your PAN and Aadhaar match exactly to avoid verification issues.

With the New Year approaching, this is the final opportunity to avoid complications in your financial and tax matters. Act now to ensure your PAN remains active and your transactions uninterrupted.

Discover more from SD NEWS agency

Subscribe to get the latest posts sent to your email.