Opportunity for Retail Investors:

Retail investors have a chance to buy shares of the government-owned Bharat Heavy Electricals Limited (BHEL) today at a discounted price. The government is selling its 5% stake in BHEL through an Offer for Sale (OFS). While non-retail investors could participate on Wednesday, retail investors can place their bids today. The floor price for the shares has been set at ₹254 per share. In the previous session, BHEL shares closed at ₹260.65 on the BSE, down 5.58%.

Strong Institutional Response:

Institutional investors showed strong interest on the first day of the sale, bidding over ₹5,650 crore. The OFS was more than twice subscribed on day one. Arunesh Chawla, Secretary of the Department of Investment and Public Asset Management (DIPAM), told X that the government has decided to exercise the green-shoe option, allowing the sale of the full 5% stake in the company.

Government Stake Details:

The government has set a minimum price of ₹254 per BHEL share. Selling its 5% stake is expected to raise ₹4,422 crore. On Wednesday, institutional investors bid for more than 22.07 crore shares at an average price of ₹256.07, although only 9.40 crore shares were offered to them. The total sale of 17.41 crore shares (5% stake) will add ₹4,422 crore to the government’s coffers. Currently, the government holds a 63.17% stake in BHEL.

So far this fiscal year, the government has raised a total of ₹8,768 crore through disinvestment in public sector companies.

Market Update:

BHEL shares opened lower today, down 6%, as the government offers the stock at an 8% discount, presenting an attractive entry point for retail investors.

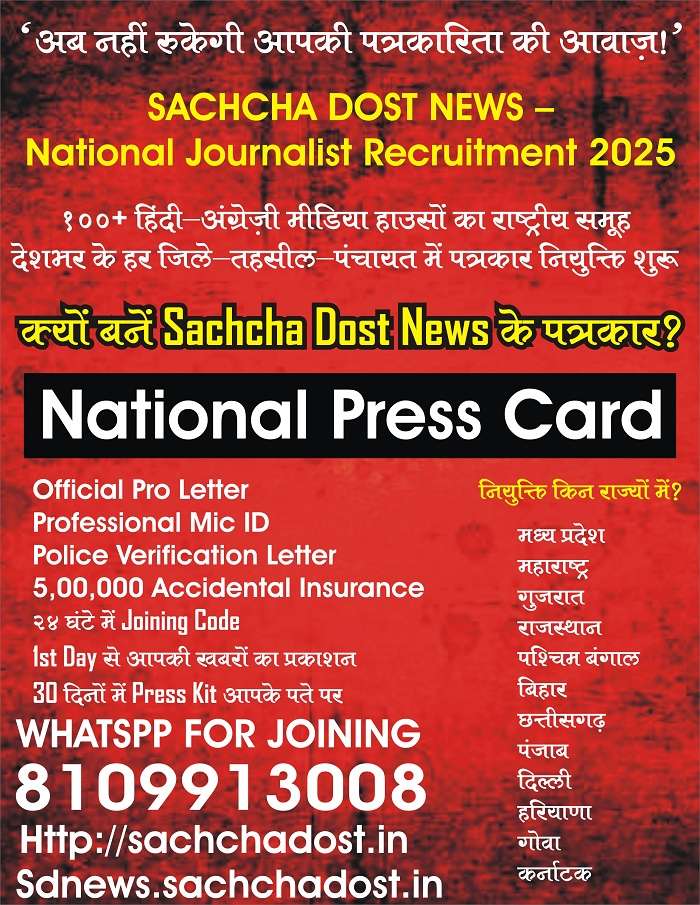

Discover more from SD NEWS agency

Subscribe to get the latest posts sent to your email.