New Delhi: With prices skyrocketing across the board, everyone—from salaried employees to self-employed individuals—is feeling the pinch of inflation. Household essentials have become costly, rent has surged, and even commuting expenses, such as auto or tempo fares, have risen significantly. Yet, most people’s incomes have not kept pace. So, what can one do?

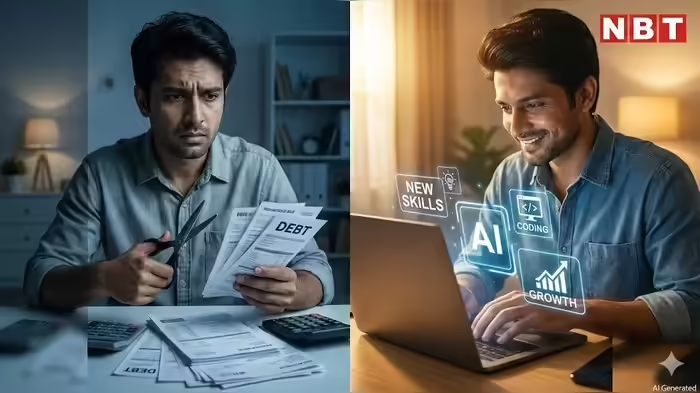

The Common Approach: Tightening the Belt

It is often observed that when salaries fail to keep up with inflation, people start cutting down on expenses. Aside from staples like rice and lentils, discretionary spending is reduced. Daily milk consumption may drop from two liters to one, and use of items like cooking oil or soap is minimized.

But This Strategy Doesn’t Work

According to Chartered Accountant Nitin Kaushik, simply cutting expenses is largely ineffective. In a recent post on social media platform X, he explained that focusing solely on reducing costs is “a losing battle.” While his advice may sound counterintuitive, it is based on practical arithmetic and has gained attention amid rising inflation.

Inflation Isn’t Temporary

Kaushik emphasizes that inflation is not a short-term phenomenon—it is part of the economic system. Over the past three years, prices of everyday goods have increased by approximately 20%. While it is natural to worry about rising prices, focusing only on costs masks the bigger problem: income growth hasn’t kept pace with inflation. Expecting prices to revert to previous levels is unrealistic, as the value of money naturally declines over time.

A Different Strategy is Needed

Kaushik illustrates this with a simple example. Suppose a person has a monthly expenditure of ₹4,000. Even if they manage to cut expenses by 10%, they would save only ₹400. Achieving this requires significant lifestyle sacrifices, yet the financial benefit remains minimal. On the other hand, if the same person increases their income by 20%—through learning a new skill, changing jobs, or starting a side hustle—they could save at least ₹800. While both approaches require effort, the latter yields far greater results.

The Limits of Cutting Expenses

According to Kaushik, there is only so far one can reduce expenses—you cannot reduce them below zero. Income, however, has no upper limit. By learning new skills, obtaining better-paying jobs, or taking up additional work, individuals can increase their earnings and improve their financial health without compromising their lifestyle.

In short, combating inflation effectively is less about cutting corners and more about expanding earning potential—a strategy that not only protects your finances but allows you to continue enjoying life.

Discover more from SD NEWS agency

Subscribe to get the latest posts sent to your email.