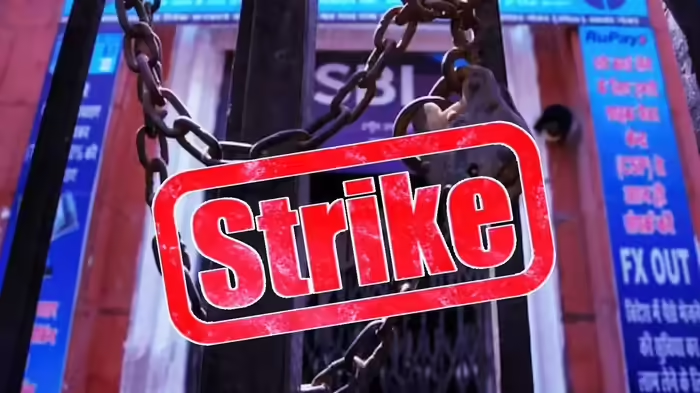

In a nationwide strike demanding a five-day workweek, the United Forum of Bank Unions (UFBU) brought banking operations to a standstill, affecting cheque clearances, cash deposits, and withdrawals. Approximately eight lakh bank employees participated, resulting in an estimated ₹4 lakh crore worth of cheques being held up, while several ATMs ran out of cash.

Strike Hits Banking Services Across the Country

New Delhi: The UFBU, a coalition of nine major bank officers’ and employees’ unions, called a countrywide strike on Tuesday after failing to reach a resolution in a meeting with the Chief Labour Commissioner on 23 January. The strike primarily targeted public sector banks, with employees seeking a shift to a five-day workweek.

C.H. Venkatram, General Secretary of the All India Bank Employees’ Association (AIBEA), said the strike led to an estimated ₹4 lakh crore of cheque clearances being delayed. Cash transactions at public sector banks were severely disrupted in several states. Other banking operations, including bill trading, bill discounting, and treasury-related work, were also affected.

Rupam Roy, General Secretary of the All India Bank Officers’ Confederation (AIBOC), highlighted that following discussions in December 2023, it had been agreed that weekday working hours would be increased by 40 minutes, while Saturdays would be designated holidays. Despite recommendations sent to the government, no approval was received over the past two years.

Reports from states such as Madhya Pradesh and Jharkhand indicated that banking services were badly affected, with numerous ATMs running dry. Most public sector bank branches nationwide were either completely closed or operating partially, as both officers and employees participated in the strike.

While public sector and some older private banks experienced disruptions in cash deposits, withdrawals, cheque clearances, and administrative work, major private banks such as HDFC Bank, ICICI Bank, and Axis Bank remained largely unaffected since their employees are not part of the striking unions. Digital banking services such as UPI and internet banking continued to operate normally. Leading public sector banks, including the State Bank of India (SBI), had preemptively informed the stock markets about potential impacts of the strike.

Unions Stress Importance of a Five-Day Workweek

L. Chandrashekhar, General Secretary of the National Confederation of Bank Employees (NCBE), said the success of the strike underscores the urgent need for a five-day workweek. He emphasized that it is crucial for employees’ work-life balance, well-being, and sustainable banking operations.

Bank employees have long demanded a five-day week, citing the benefits of reducing stress and improving efficiency. The strike also impacted the general public, with many unable to access funds or deposit cheques. Cash shortages due to empty ATMs caused further inconvenience for customers.

Discover more from SD NEWS agency

Subscribe to get the latest posts sent to your email.